About the Mandatory Purchase of Flood Insurance Requirement

NFIP: The City of Jeffersonville participates in the National Flood Insurance Program (NFIP), which makes federally-backed flood insurance available for all eligible buildings, whether they are in a floodplain or not.

Flood insurance covers direct losses caused by surface flooding, including a river, lake or stream flowing over its banks and local drainage problems.

The NFIP insures buildings, including mobile homes, with two types of coverage: building and contents. Building coverage is for the walls, floors, insulation, furnace, and other items permanently attached to the structure. Contents coverage may be purchased separately, if the contents are in an insurable building.

The City of Jeffersonville recently received notice from FEMA that the City meets the criteria for a Level 8 rating in the Community Rating System. The floodplain management activities implemented by the City have qualified it for a ten (10) percent discount in the premium cost of flood insurance for NFIP policies issued or renewed in Special Flood Hazard Areas on or after May 1, 2014. Preferred risk policies are not eligible for this discount. For more information, please contact the City Storm Water Department at 285-6476.

Mandatory Purchase Requirement: The Flood Disaster Protection Act of 1973 and the National Flood Insurance Reform Act of 1994 made the purchase of flood insurance mandatory for federally backed mortgages on buildings located in Special Flood Hazard Areas (SFHAs). It also affects all forms of Federal or Federally related financial assistance for buildings located in SFHAs. The SFHA is the base (100-year or 1%) floodplain mapped on a Flood Insurance Rate Map (FIRM). It is shown as one or more zones that being with the letter “A” or “V.”

The rule applies to secured mortgage loans from such financial institutions as commercial lenders, savings and loan associations, savings banks, and credit unions that are regulated, supervised, or insured by Federal agencies such as the Federal Deposit Insurance Corporation (FDIC) and the Office of Thrift Supervision. It also applies to all mortgage loans purchased by Fannie Mae or Freddie Mac in the secondary mortgage market.

Federal financial assistance programs affected by the laws include loans and grants from agencies such as the Department of Veterans Affairs, Farmers Home Administration, Federal Housing Administration, Small Business Administration, and the Department of Homeland Security’s Federal Emergency Management Agency (FEMA).

How it Works:

Lenders are required to complete a Standard Flood Hazard Determination (SFHD) form whenever they make, increase, extend or renew a mortgage, home equity, home improvement, commercial, or farm credit loan to determine if the building or manufactured (mobile) home is in a SFHA. It is the Federal agency’s or the lender’s responsibility to check the current Flood Insurance Rate Map (FIRM) to determine if the building is in a SFHA. Copies of the FIRM are available for review in the Jeffersonville Building Commissioner’s office at the City Hall, 500 Quartermaster Court, second floor. Lenders may also have copies or they use a flood zone determination company to provide the SFHD form.

If the building is in a SFHA, the Federal agency or lender is required by law to require the recipient to purchase a flood insurance policy on the building. Federal regulations require building coverage equal to the amount of the loan (excluding appraised value of the land) or the maximum amount of insurance available from the NFIP, whichever is less. The maximum amount available for a single-family residence is $250,000. Government sponsored enterprises, such as Freddie Mac and Fannie Mae, have stricter requirements.

The mandatory purchase requirement does not affect loans or financial assistance for items that are not covered by a flood insurance policy, such as vehicles, business expenses, landscaping, and vacant lots. It does not affect loans for buildings that are not in a SFHA, even though a portion of the lot may be. While not mandated by law, a lender may require a flood insurance policy, as a condition of a loan, for a property in any zone on a FIRM.

If a person feels that a SFHD form incorrectly places the property in the SFHA, he or she may request a Letter of Determination Review from FEMA. This must be submitted within 45 days of the determination. More information can be found at FEMA.gov or Floodsmart.gov

Flood Insurance Rate Maps (FIRM)

Knowing whether a property is located within a flood zone and whether an elevation certificate is available for the property are important factors in any real estate transaction. Besides being important from a disclosure perspective, a flood zone determination will help determine if purchasing flood insurance is mandatory for the property in question. With an elevation certificate, properties located in flood zones can receive lower flood insurance rates.

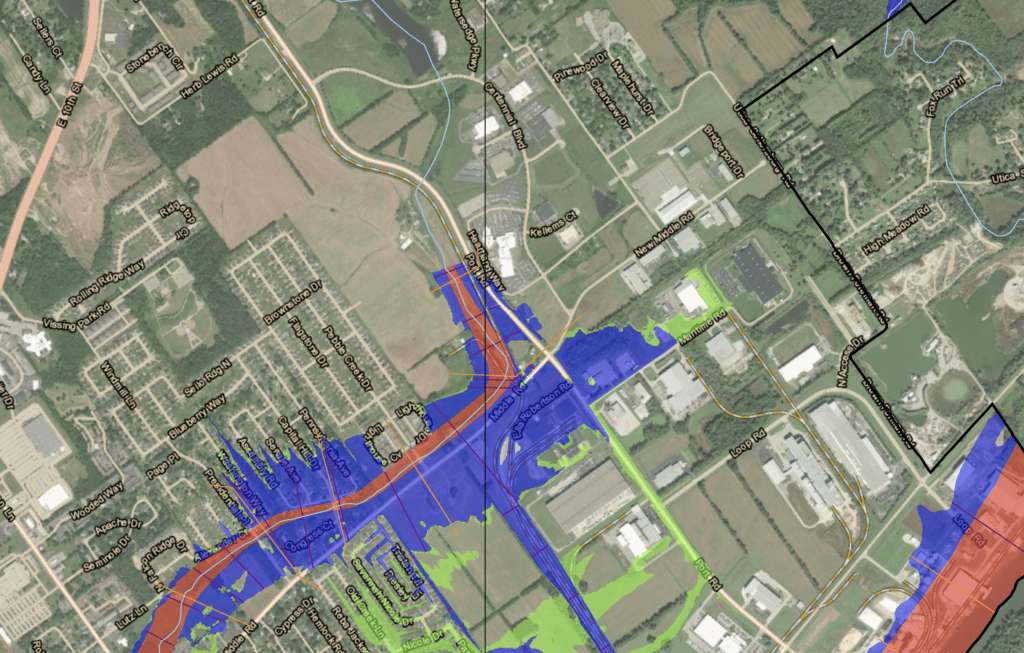

Flood Insurance Rate Maps (FIRM) are provided by the Federal Emergency Management Agency (FEMA) to determine flood zones. The Jeffersonville Building Commissioner’s office has paper copies of the current FIRM available for viewing at 500 Quartermaster Court. FIRMS can also be accessed through the FEMA Map Service Center website.

Additionally, the interactive map at the top of this website page can be used to help determine if your property is considered in a floodplain.

To view the August 31, 2012, Flood Insurance Study (FIS) for Clark Countyopens PDF file click on the link above or ask for a copy at the Building Commissioner’s office.

Floodplain Permit Requirements

All development within the 100-yr. floodplain (not just construction of buildings, but also filling, excavation, fences, etc.) may be required to obtain a City of Jeffersonville permit. Applications must be made prior to doing any work in a floodplain.

Please contact the Building Commissioner’s Office at (812) 285-6412 to find out what you will need in order to properly develop in the floodplain. You may report any illegal development activities to the above number as well.

Substantial Improvement/Damage

The NFIP requires that if the cost of improvements to a building – or the cost to repair damages (from any cause) to a building – exceeds 50% of the market value of the building (excluding land value), the entire building must be brought up to current floodplain management standards. Building improvement projects include exterior and interior remodeling, rehabilitation, additions and repair and reconstruction projects.

Elevation Certificate Review

The City of Jeffersonville maintains Elevation Certificates (EC) for structures in the Special Flood Hazard Area (SFHA). These ECs are available for review at the City of Jeffersonville Building Commissioner’s office located on the second floor of City Hall.

Natural & Beneficial Functions

Floodplains play a valuable role in providing natural and beneficial functions to the area around, and including, Jeffersonville. Floodplains that are relatively undisturbed provide a wide range of benefits to both human and natural systems. These benefits provide aesthetic pleasure as well as function to provide active processes such as filtering nutrients and pollutants from urban stormwater runoff. Floodplains also provide natural erosion control and open space so further flooding damage does not occur.

Drainage System Maintenance

As simple as it may sound, simply keeping smaller ditches and streams free of debris can dramatically improve the runoff capacity of low-lying areas, as well as greatly reduce the occurrence of blockages that significantly contribute to flooding. It is illegal to dump materials into the City’s storm sewer system and waterways. If you see someone in the act of dumping or see debris in one of our watercourses, please contact the Stormwater office at (812) 285-6476.

Additional Information

If you should require further or more detailed information regarding flood-related issues in Jeffersonville, here are some additional sources:

National Weather Service Ohio River Stream Gauges

Ohio River levels are forecasted for the next four days at both the Upper McAlpine and Lower McAlpine gauges.